A Recap of 2022

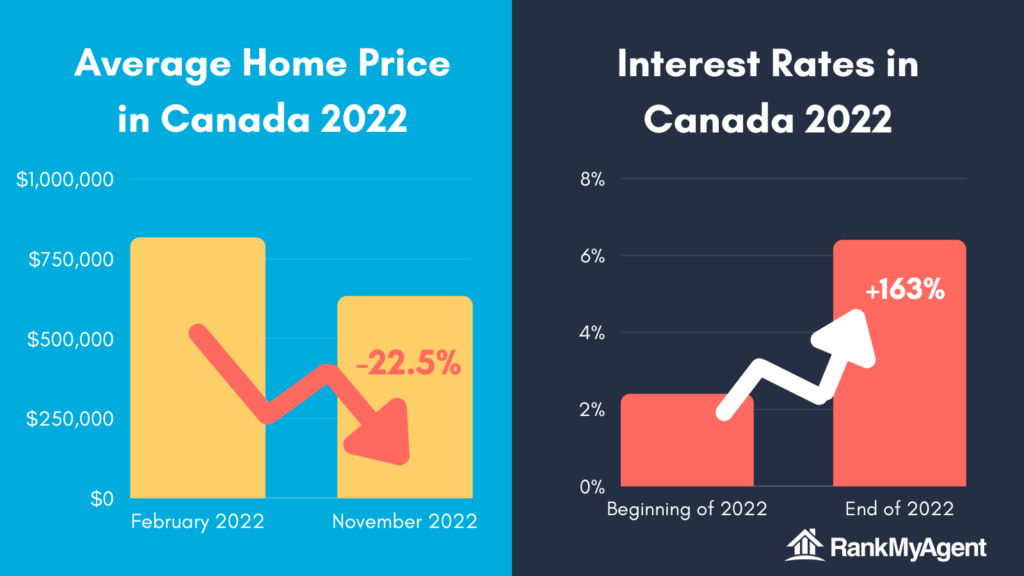

In 2022, the real estate market continued to have hiking home prices with a decrease in home sales, especially towards the end of the year as interest increased. According to The Canadian Real Estate Association, starting in November 2022, there was a 3.3% month-over-month decline in national home sales. Compared to 2022’s peak in February with an average of $816,720, the national average home price in November 2022 was $632,802 which is a 22.5% decrease. The amount of newly listed properties have also declined by an average of 1.3% month-over-month in November, with larger declines in the B.C. Lower Mainland and Okanagan regions. November 2022 marked the lowest number of new listings in a month in 17 years.

With the current inflation rates in Canada, it has forced interest rates to increase as well. The Bank of Canada kept raising rates aggressively in 2022, with a 100-basis point hike in July. This month’s hike marks the 8th time the Bank raised rates since March 2022. As of Jan 25, 2023, the overnight rate stands at 4.5%.

Will home prices drop in 2023 and bottom out?

While Canadians will still likely continue to struggle with inflation in 2023, RE/MAX anticipates that 60% of housing markets will see more balanced conditions, meaning the supply and demand for housing will be more even compared to 2022. This is expected to be more apparent during the third and fourth quarters of 2023, especially in the Greater Toronto Area (GTA), Mississauga, Greater Vancouver Area (GVA), Calgary, Regina, and Winnipeg. The largest price declines are forecasted to be in Ontario and Western Canada where several cities can see a 10-15% decline. However, Atlantic regions such as Halifax and St. John’s are expected to see an 8% and 4% increase in home prices respectively. TD bank predicts that Canadian home sales will bottom in early 2023.

Despite the 2023 housing market predictions, Vancouver is still anticipated to be the most expensive region, averaging a home price of $1.2 million. On the other hand, Regina will have the most affordable prices with an average of $361,495 by the end of 2023. Royal Lepage notes home prices have declined from the highs earlier last year, but are still higher than pre-pandemic. The projected average home price in Canada for Q4 2023 is estimated to be 15% higher than Q4 2020 and 18.4% higher than Q4 2019.

Although house prices will fall, rents are projected to rise as there was a lack of rental listings. In 2022, the average price of a single bedroom apartment in Toronto is now $2481 a month which has increased 20% year-over-year. The hike in rental prices is mainly because listings have gone down 25.6%, causing there to be a lack of supply. However, due to such high prices, most Canadians cannot afford to buy a house and hence, there are more renters than homeowners. This is prominent in cities such as Montreal, Quebec City, and Halifax as more than 50% of the buildings built since 2016 are rented. From a survey conducted by RE/MAX, 15% of Canadians are debating about moving to a different province for better housing availability and livability.

Will there be New Regulations in 2023?

The Government of Canada can see how inflation has caused houses to be less affordable for Canadians so they have taken new measures to counteract the problem.

To make homes more affordable to Canadians, the Government of Canada has passed the Prohibition on the Purchase of Residential Property by Non-Canadians Act which came into effect on January 1, 2023. This Act prevents non-Canadians or corporations that are not incorporated in Canada, from buying residential property for 2 years beginning on January 1, 2023. According to the Government of Canada, residential property is defined as a building with 3 homes or less and parts of buildings such as a semi-detached house or a condominium unit. If this law is violated, the non-Canadian or anyone who intentionally assists a non-Canadian, will receive a $10,000 fine and the court may request the sale of the house. This new regulation can help make sure that homes are being used by Canadians to live in and not as assets for foreign investors.

For foreigners who already own a house in Canada, they will need to pay a 1% vacant home tax annually if the home is underused. This measure is to ensure that non-Canadians pay their fair share of Canadian tax and in hopes that this will free up more homes for Canadians.

The last measure is to add Goods and Services Tax/Harmonized Sales Tax (GST/HST) on all houses that are resold before it has been built or lived in. This was effective as of May 7, 2022 and can help reduce homes being sold for high prices.

All three regulations are made for the same purpose – to make homes more affordable and increase the number of Canadian homeowners.

Housing Market 2023 Predictions

As 2022 was still a year of hiking home prices, the Government of Canada is taking measures to help Canadians become homeowners at more affordable prices. Although interest rates are expected to remain the same, house prices are forecasted to decrease in many regions. Based on the trends, 2023 is predicted to be a year with a more balanced market.