“Vacant home tax” has been a buzzword for politicians, Canada’s real estate community and the population at large for a few years now. This is the second year of the vacant home tax in Toronto that was implemented by the re-elected Liberal party, led by Justin Trudeau when they passed their budget before the September 2021 election. Toronto is one of the first cities in Ontario to implement a vacant home tax as all residential property owners have received a notice stating “all residential property owners are required to declare the occupancy status of their residential property(s) annually.”

This year the deadline to declare was February 29, 2024. It has recently been found that the city has accidentally sent out notices to 167, 000 homeowners even though in 2022 only approximately 11,000 homes were deemed vacant. The city has admitted it has been due to the flaw in the program design and are now working to remedy this issue with improvements in the technology and customer interface, a revamped communication strategy and making it easier to declare. City staff are now prioritizing reviewing notice of complaints submitted and reversal of charges.

Places like British Columbia have had vacant real estate taxes for a few years now. Is the vacant home tax achieving its goal of reducing real estate prices? Where has the tax been implemented before, and what were its results? This article will analyze the various proposals for vacant home taxes and look at places like BC and now Toronto, which have instituted such a tax to see how effective they can be.

Friendly reminder: Please speak to an accountant or tax professional when dealing with any potential taxes (be it on your property or personal income). This article provides information about taxes – not tax advice.

Which Ontario cities have the vacant home tax?

Income taxes are prevalent worldwide at Federal, Provincial and State levels. Of course, the specific income tax in different regions varies in what percentage of income is taxed, and vacant home taxes can vary in the same way. On top of what percentage is taxed off the value of an empty home, how that tax is enforced can differ in numerous ways.

Vaughan, Markham and York Regions: Have decided to halt plants to more forward with a vacant home tax in 2024. They are currently observing the impact that the vacant home tax is having in Toronto

Mississauga and Hamilton: The vacant home tax is on hold in the Peel region due to Bill 112 which has initiated a process to dissolve the Peel Region effect Jan 1, 2025.

The Toronto vacant home tax puts the onus on property owners to declare if a home is vacant each year, and the city will investigate possible homes suspected to be vacant. Toronto vacant home tax seems to have many devices to tackle homeowners with vacant homes that have not declared their residences as such. On top of being subject to the tax, the city may subject non-declaring owners to various penalties and fines. Toronto’s tax is set at 3% in 2024 a significant hike from 1% from previous years and will be levied on all Toronto residences that are declared, deemed or determined to be vacant for more than six months during the previous year. As of October 2023, the city has collected $54 million in VHT (Vacant Home Tax). In 2024 the projected revenue is going to almost double to $105-110 million as projections from the Toronto City Council.

Overall, the much-discussed vacant home taxes in Toronto follows a similar structure of self-declaration and enforcement through auditing.

What is the Toronto Vacant Home Tax Declaration in Toronto?

Property owners in Toronto must annually now declare the occupancy status of the properties they own, regardless if they are currently living in the property.

This declaration will determine if the Vacant Home Tax will apply and needs to be paid.

The Vacant Home Tax is 1% of the Current Value Assessment (CVA) for the 2023 year and applies to Toronto homes declared, deemed, or found vacant for over 6 months in the previous year. The tax is based on the property’s occupancy status in the previous year.

To declare, you’ll need your 21-digit assessment roll number and customer number from your property tax bill or statement. Declarations can be made through the City’s online portal or via a paper form. Incomplete paper forms will not be accepted. Owners of unoccupied properties may be subject to an audit.

Corrections to declarations can be made before the February 29 deadline or by filing a Notice of Complaint after the deadline. Failure to declare or making a false declaration may result in a fine of $250 to $10,000.

Some Exemptions exist where a property can be left vacant and the tax does not need to be paid:

| Eligible Exemption | Description | Supporting Documentation |

| Death of a registered owner | The property was vacant for six months or more in the previous year due to the death of an owner. | Copy of death certificate. |

| Repairs or renovations | The vacant property is undergoing repairs or renovations, and all the following conditions have been met: a) occupation and normal use of the vacant property is prevented by the repairs and renovations; b) all necessary permits have been issued for the repairs and renovations; c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay. | Description of the type of project preventing occupancy. Copy of building permits issued related to the repairs and renovations. |

| Principal resident is in care | The principal resident of the vacant property is in a hospital, long term or supportive care facility for at least six months during the taxation year. This exemption may be claimed for up to two consecutive taxation years. | Signed letter from health care facility on letterhead. |

| Transfer of legal ownership | You purchased your property with a closing in the taxation year being declared, and the sale involved a 100 per cent transfer of an interest in the property to an unrelated individual or corporation. This excludes name changes, adding a second owner and removing a second owner. | Copy of land transfer deed. |

| Occupancy for full-time employment | The vacant property is required for occupation for employment purposes for a total of at least six months in the taxation year, by its owner who has a principal residence outside of the Greater Toronto Area. | Proof of residency outside of Greater Toronto Area. Signed letter from employer on company letterhead or employment contract. |

| Court order | There is a court order in force which prohibits occupancy of the vacant property for at least six months of the taxation year. | Copy of court order. |

Source: https://www.toronto.ca/services-payments/property-taxes-utilities/vacant-home-tax/

What was the effect of British Columbia’s vacant home tax?

BC’s vacant home tax (the “Speculation and vacancy tax”) turned three years old at the end of 2020. Like the goals of the proposed vacant home taxes in Ontario, BC implemented the tax to increase the affordability of real estate. Owners must declare if their home is vacant, and if vacant, the relevant tax rates apply.

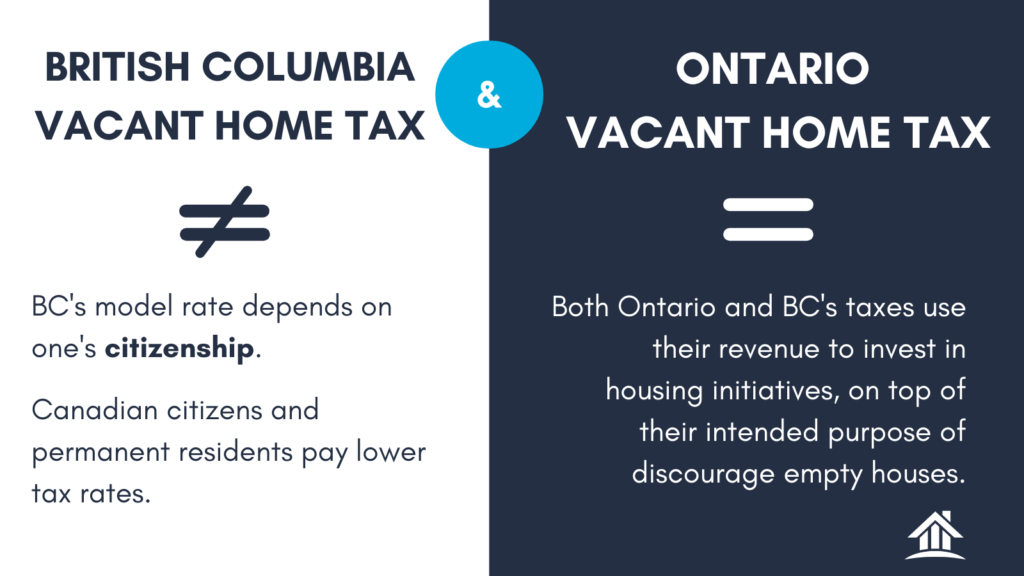

The BC model differs from the Toronto Vacant Tax because the rate depends on one’s citizenship. After 2019, the tax rate stayed at 0.5% from its 2018 level for Canadian citizens and permanent residents who are not part of a satellite family. However, if you are a foreign homeowner or a satellite family, your tax rate will be 2% off the value of your home.

Vancouver’s empty home tax has a similar structure of administration (declaring, audits, etc.) but increased to a tax rate of 5% in 2023 compared to 3% in 2021-2022. However, Vancouver and BC’s taxes are, of course, different – theoretically, someone could be exempt for both or have to pay both when the taxman comes knocking. Hence, a Canadian citizen may have to pay Vancouver’s 5% tax and BC’s 0.5% tax for their empty home. If Ontario were to implement a vacant home tax on a provincial level, it would likely interact with the taxes of its municipalities like Toronto similarly.

In terms of effect, both taxes use their revenue to invest in housing initiatives, on top of their intended effect to deter empty houses. For the fiscal year 2020, BC raised $81 million for affordable housing programs. Vancouver and BC is currently a balanced market – However, BC housing prices are still unaffordable for many people. So, evaluating the effectiveness of the taxes becomes a bit of a chicken or the egg situation – is the tax ineffective? Or would prices have increased even more without their implementation? One of the tax goals, to stop houses from being vacant, seems to be effective, with rental units increasing in metro Vancouver.

The city of Toronto is estimating the tax will bring 66 million in revenue per year, which will be used to create affordable housing.

A vacant home tax may be necessary for a stable and affordable housing market, but by no means is sufficient. A generous reading of the tax is that it is a certified revenue earner and helps increase rental vacancy but is insufficient to cool rising real estate prices. At its worst, it seems that the vacant home tax has no meaningful effect on the housing market but remains an effective revenue earner. Taxes will likely have to be used with supply increases and zoning reform to adjust the market properly. As the tax continues to be encforced in 2024 , the public should know that they are not a panacea but one tool in a toolbox to make real estate affordable.