Vancouver has long been known as the most expensive real estate market in Canada – until now. In 2022, Toronto is now Canada’s most expensive real estate market, while Vancouver has fallen to number two. If you want to buy a home in one of these two cities, it’s a far-from-easy task – rent, a mortgage, or other living expenses in Vancouver and Toronto are all pricey.

Let’s get into specifics, though – if you want to save for a down payment on a home in either of these cities, what kind of salary do you need? What if you also pay rent and want an average city lifestyle? We’re going to answer these questions and break down Vancouver and Toronto real estate prices.

It’s been no secret that housing sales have been one of the pandemic stories. In the Greater Toronto Area, there remains a strong demand for homeownership. Sales were down year over year for February in 2022 – however, the average selling price for all types of homes was up 27.7% to $1 334 555. For Metro Vancouver, the Real Estate Board of Greater Vancouver represented an 8.1% decrease in home sales year over year for this February. The average price of all homes was $1 313 400, a 20.7% increase from February 2021.

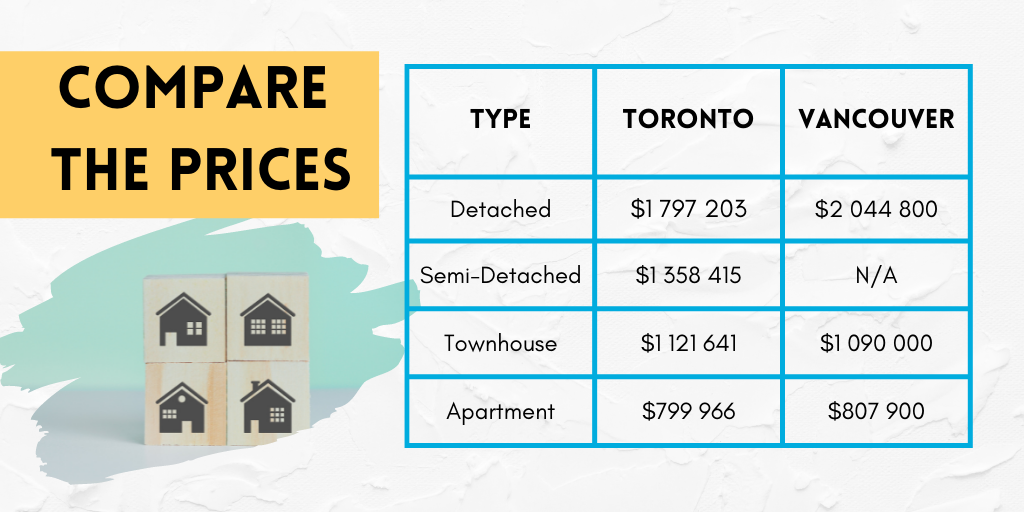

While both markets need more homes, Toronto’s supply might have overtaken Vancouver. In Toronto, fewer new homes are being built than in Vancouver, which has seen a slight increase. The average price of homes in Metro Vancouver and Toronto in February 2022 are listed below:

Conventional mortgages usually require a 20% down payment. So for even the cheapest option on the above table (Toronto apartment), it means $159 993 for only the down payment.

If you want to move to one of these cities to start a family in a detached home, it costs well $1.5 million. A 20% down payment for an average Vancouver detached is around $408 960 and for an average Toronto detached is about $359 440

To save $350 000 for only the down payment on a house is a difficult feat. Even $159 000 for a Toronto apartment is intimidating.

Now that you know what you need to save for the down payment let’s look at some everyday city-lifestyle expenses.

Because real estate prices aren’t low, rent isn’t either. According to housing rental tech company Zumper, the average cost for a single-room apartment in Vancouver is $2200/month. A two-bedroom apartment is $1550/month (suggesting you have a roommate split the costs). While Toronto has now moved past Vancouver at the price of buying a house, the city is doing better when it comes to renting affordability. In Toronto, a solo lifestyle costs $1900/month and living with a roommate costs $1200/month.

Modern-day necessities like a cell phone and home internet cost around $74/month, while a monthly transit pass costs $100 in Vancouver and $156 in Toronto. And if you’re like most city dwellers, $60 for Ubers and taxis every month can come in handy. Lastly, around $300 for groceries every month is necessary for the days and nights you aren’t eating out. So your monthly necessity expenses should approximate $608 if you’re in Vancouver or $664 if you’re in Toronto.

What about the unessential? If you buy two lunches a week (at $20/lunch) and dine out for dinner twice a week (at approximately $30/dinner before drinks), that’s already $400 a month. And then budget in three $3 coffees a week, and that’s another $36/month. So finally, a fair estimate is $250/month for drinks and entertainment and $170/month for extras (maybe for a trip to the salon or a new pair of loafers?). So your monthly total for non-essentials should approximate $906/month, regardless of the city.

The last item on the list is a gym membership. If the condo gym isn’t cutting it for you or if you want a few specialty classes like cycling or kickboxing, it’s not going to come cheap. The standard gym membership is $60/month. This covers both classes and a more comprehensive range of equipment.

| TYPE | VANCOUVER SINGLE | TORONTO SINGLE | VANCOUVER ROOMMATE | TORONTO ROOMMMATE |

| Rent | $2200 | $1900 | $1550 | $1200 |

| Cellphone | $74 | $74 | $74 | $74 |

| Internet | $74 | $74 | $74 | $74 |

| Monthly transit pass | $100 | $156 | $100 | $156 |

| Taxi/Uber/Lyft | $60 | $60 | $60 | $60 |

| Gym | $60 | $60 | $60 | $60 |

| Dining out | $400 | $400 | $400 | $400 |

| Coffee | $36 | $36 | $36 | $36 |

| Groceries | $300 | $300 | $300 | $300 |

| Entertainment & Drinks | $250 | $250 | $250 | $250 |

| Extras | $170 | $170 | $170 | $170 |

| Total expenses per month | $3724 | $3424 | $3074 | $2724 |

If you tally up the expenses, living in either city in your apartment costs around $3500/month! Living with one roommate costs slightly above $3000 in Vancouver and approximately $2700 in Toronto. This doesn’t include yearly expenses like vacations or Christmas shopping. Additionally, if you have a car or outstanding debts, that’s a whole new budget.

Conclusion

In this scenario, the plan is to go from nothing to a down payment in five years. This is how much you would need to save for the following:

Adding in monthly expenses, buying a Vancouver detached while living alone or a Toronto detached while living with a roommate requires a net annual income of around $104 568-$126 480. To afford a Vancouver apartment while living alone or a Toronto apartment while living with a roommate requires an annual net income of $64 680-$80 244. All scenarios are expensive, but it is essential to keep in mind that a lot can change in 5 years (prices could go down or go up quite a bit).

Other things to consider

Vancouver and Toronto are two very different cities, and the price of a property is only one of many characteristics of each city. Vancouver provides milder weather; there are less extreme hots and colds than Toronto. Vancouver is also great for the outdoorsy people, with Stanley Park only steps away from the city’s core. In contrast, people cite Toronto for better and higher-paying career opportunities. The city is also better known for its restaurants, bars, and nightlife in comparison to its west-coast counterpart.