It’s no secret that Canada’s real estate sector has done well over the past couple of years. Both 2020 and 2021 had a record number of sold homes, and the national MLS Home Price Index finished the year up a record 25.3% from 2020. Does this mean that 2022 is the time to enter the market? Or has that ship sailed? Investors fear not: real estate still seems like a good investment.

PriceWaterhouseCooper (PWC) released its annual report describing real estate trends in Canada. While investors must consider some new or increased risks, PWC found that there is still great optimism in the sector, “with business prospects for 2022 returning to above pre-pandemic levels in almost all categories.” The cause for a bright outlook is pinned on population growth and efforts to increase supply to address demand. As a result, there are still many opportunities to invest from now into the coming years. REMAX predicts that by the end of 2022, average residential prices will have risen by 9.2 %. RBC has predicted Canada’s housing market will cool in 2022 but will stay strong due to lack of supply, demographic shifts and immigration.

This article explains both why and how to invest in Canada’s flourishing real estate markets in 2022. We look at the appreciating values and rising rental incomes of Canadian properties and what to look out for when making your investment.

Why Canadian real estate?

There are pros and cons of investing in Canada, of course, and then there are also pros and cons of investing in particular provinces and cities. But generally, Canadian real estate has continually appreciated property value and rental earnings over the past years. As mentioned earlier, the national MLS Home Price Index has increased over 25% since the dawn of 2020. The headlines show that real estate prices have boomed in Toronto and Vancouver, but since 2020 buyers’ markets and balanced markets have transformed into sellers’ markets. Alberta, for example, has seen Calgary and Edmonton switch to sellers markets, and Moncton and Halifax on the east coast are expected to go up from 16-20% in 2022.

While appreciation is great, rental income is also an important part of your real estate investment. According to rentals.ca, the national average rent has gone up over the past year. In February 2022, the average rent was $1820, 6.2% higher than last year. Especially due to inflation and rising interest rates, rent prices are predicted to continue their slow upward trend.

In terms of regulatory risk, municipal and provincial jurisdictions are looking to pass more tenant-friendly regulations and also specifically target short-term rentals. Sicamous, B.C. is planning a short-term rental regulation that would limit potential revenues for Airbnbs or similar services. London, Ontario, is also looking at various ways to limit Airbnbs. Due to the lack of affordable housing, such regulations will be increasingly likely to be implemented in 2022.

How to make money investing in Canadian real estate

With residential real estate, the increase in property value and rental income are the two main ways to produce a profit. As mentioned before, Canadian real estate excels in both categories. But there are also other costs to worry about aside from the property’s price. Interest payments, transaction fees, taxes, and more can eat into how much you make.

Property value

Canadian properties have gone up a lot over the past few years and will most likely continue to appreciate in the long term. But it’s a mistake to assume that property values will consistently go up. The real estate market experiences highs and lows, and investors who can’t stomach volatility or need to sell quickly in a down market may lose money. While Canada’s housing boom has been “unprecedented,” Oxford economists predict there will be a 24% correction within two years. However, keep in mind that housing prices have gone up 50% over pre-pandemic levels. Like the stock market, housing tends to go up in the macro picture. Still, speak with a real estate professional to see whether it’s a good time to buy or if you should wait for the market to go down. Although a realtor isn’t some sort of oracle, they can provide insight into whether prices may go higher or lower in your area. If you get into an investment when the market is low, it’ll be easier to make money.

Rental income

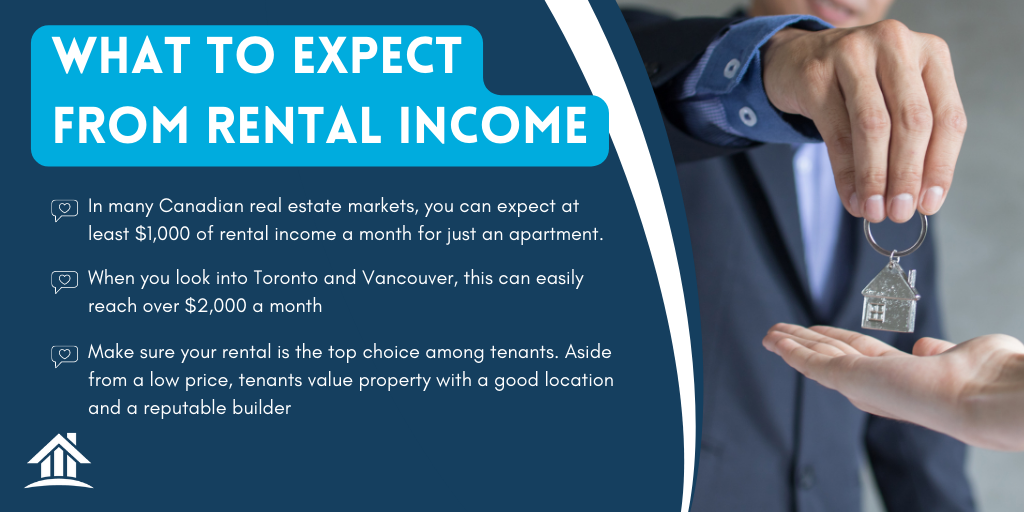

In many Canadian real estate markets, you can expect at least $1,000 of rental income a month for just an apartment. When you look into Toronto and Vancouver, this can easily reach over $2,000 a month. Although vacancy rates are tightening, there are a few things to keep in mind to make sure that your rental is the top choice among tenants. Aside from a low price, tenants value property with a good location and a reputable builder.

As the saying goes, location, location, location. A property at the centre of the Toronto financial district will ultimately fetch more rental applications and a higher rental price than a spot in the suburbs—of course, it’ll be more expensive to purchase. But also keep in mind locations that may be noisier, such as those close to a railroad or areas with higher crime rates. This can turn off tenants and make your property less desirable.

The builder of your property is especially important if you’re renting out a condominium. Finding a condo from a reputable builder is important. As real estate development has become so profitable in many Canadian cities, new real estate developers with little experience have continually built massive condo complexes. Because new developers lack a reputation in the market, it could be a risk to purchase a unit from them. The building could end up poorly constructed or have poor management, deterring tenants. A realtor can guide you on how a builder’s past projects have gone.

Keep down fees

There are a lot of fees associated with real estate investing that you can’t forget about. If you do, they’ll eat into your profits. A major one is the closing costs associated with purchasing the property (and later selling the property). This includes realtor commissions, lawyer fees, the cost of inspections, and more. These closing fees can total a few thousand dollars.

Then there are taxes. You’re taxed on your property’s appreciation and any rental income you earn. When you decide to sell your property, you’ll be charged a capital gains tax on the difference between your purchase and the selling price. You’ll also be charged property tax which varies from city to city. To increase housing supply and affordability, jurisdictions are also raising taxes on real estate speculators and non-residents. Nova Scotia, for example, is increasing taxes on 27 000 non-resident property owners. However, expenses can reduce these taxes, such as interest payments on your mortgage or other monies borrowed.

Canada has many great real estate markets to invest in—from the Metro Vancouver area to Halifax. The appreciation of property value combined with rental income can make you a healthy profit. But make sure to watch out for all the fees.