A 2016 Statistics Canada Census revealed that 1.9 million Canadians occupied condominiums in 2016. The demand for condo units are high, and that’s why more and more condo projects are in development. In Q1 of 2019, the Greater Toronto Area saw a record high number of new condo developments.

To fund these developments, prospective condo owners have the option to pre-purchase units before they’re even built. These units are commonly referred to as a pre-construction. If played right, a pre-construction can be a fantastic investment.

This post is all about pre-constructions. It discusses the benefits and cons of purchasing one, how the buying process works, and what questions to ask before signing the purchase agreement.

The Pros and Cons of Buying a Pre-Construction

The value of pre-construction condos is hotly debated due to the various pros and cons. Because pre-constructions are not built yet, it’s an opportunity to purchase a condo in the future at today’s prices. Although you need to pay a deposit and downpayment now, these costs are more manageable than the downpayment and mortgage of a resale property.

Another advantage of a pre-construction is the ability to customize your unit, meaning you can choose the countertops and appliances in the unit. Speaking of appliances, purchasing a brand new unit means that appliances, cable wiring, alarm systems, and other fixtures are all brand new. The need to replace these fixtures likely won’t appear for the next decade.

Although these units may look like the greatest purchase ever in the showroom, there are a lot of downsides to them. First, what you see in the showrooms and in the sales brochures are often not the reality of what you get. These marketing materials are made to give you the best impression of the product. It’s common that maintenance fees are skewed towards the low-end and that completion dates are optimistic. So, if this is an investment property, it’s hard to tell what your expenses will be or when you can expect to start renting the unit out.

What’s worse than a delay is the potential that a pre-construction is cancelled entirely. This occurs when developers can’t secure financing, have zoning issues, or can’t secure enough pre-construction buyers, among other reasons. Though with variation province to province, you would get your deposits back in this case, of course.

Lastly, there are various fees, aside from the purchase price and condo fees, that you need to account for. There are not only closing costs, but also fees unique to new developments such as development and education charges. Even items such as the installation of water and gas metres may be part of your bill. This ultimately depends builder to builder.

The Purchase Process

How to Pay for a Pre-Construction

One of the biggest drawing factors to purchasing a pre-construction is that you don’t need to pay the downpayment all at once. It’s made in staggered payments, which vary builder to builder. One example could be

- 5% of the purchase price with offer

- 5% of the purchase price after 30 days

- 5% of the purchase price after 90 days

- 5% of the purchase price after 180 days

When paying a 20% downpayment, it’s much easier to pay the amount over half a year than all at once. This gives you the opportunity to secure the unit with only 5% of the purchase price.

Cooling Off Period

To make sure you’re not forced to make a decision due to the limited supply of units, some provinces regulate a “cooling off” period after you pay your deposit for a pre-construction. In Ontario, this is 10 days while British Columbia allows for 7 days. During this time, you can renege the purchase agreement without consequences.

The cooling off period is also an opportunity to do your due diligence on the pre-construction. This means bringing the paperwork to your lawyer to check for any red flags. The period also allows you to find financing for the rest of the purchase price.

The Questions You Need to Ask before Buying

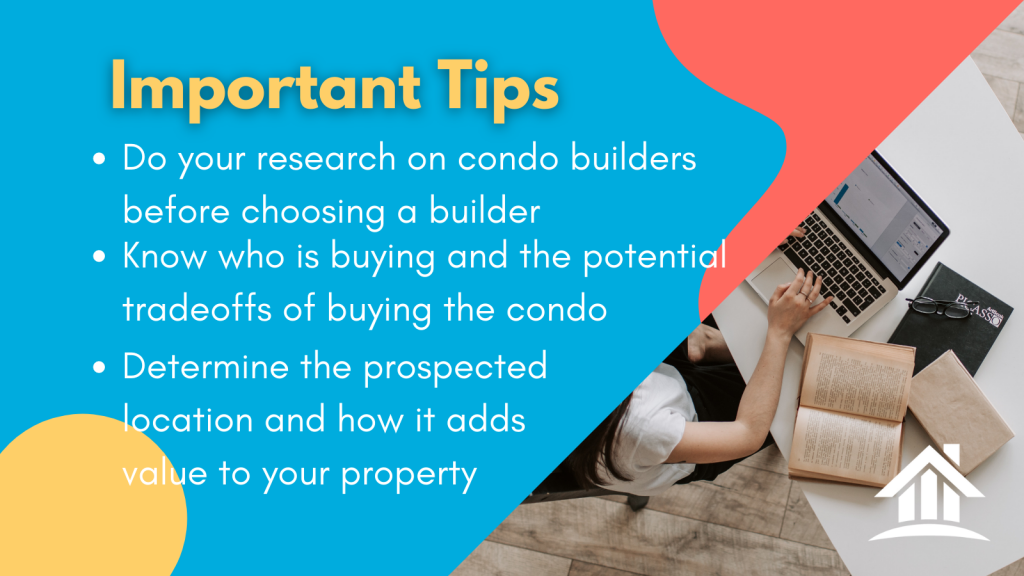

Who’s the builder? A condo developer’s reputation is one of the most important factors in buying a pre-construction. Due to the demand for condos in major Canadian cities over the past few years, many new builders have joined the game. These builders have plenty of capital and leverage but often lack experience, which results in a poor end product. It’s best to find someone with a good reputation who has had past projects with satisfied tenants. Researching the builder can also provide insight on how long their past developments were delayed for and if they delivered on the promises made in sales brochures and showroom floors.

Who are you buying this unit for? Are you buying the condo for yourself, for a long-term rental, or for a short-term rental? Make sure to check the condominium by-laws to see if short-term rentals are even allowed. If you’re purchasing for yourself, could you tolerate potential delays or not knowing who your neighbours will be?

Location: Of course, location is important. But keep in mind whether the area is somewhere renters want to live if you’re purchasing as an investment. It’s also good to look into whether the surrounding areas have been approved for development. It would be horrible to purchase a pre-construction only to discover a chemical plant is being built right beside it. Lastly, what’s the location prospected to be like by the time the development is done? Is the area going through gentrification or heading downhill?

A pre-construction condo can be a great investment. But make sure to keep in mind the benefits and downfalls of purchasing one. The payment structure and cooling off period are handy tools in the buying process, though you must make sure to ask who the builder is, who you’re buying the unit for, and about the location you’re buying into.