As the adage goes—nothing is for sure but death and taxes. To make this post less morbid, we’re going to talk about the latter—taxes. Specifically, capital gains taxes. Capital gains tax occurs when Canadians sell any real property, such as a house or piece of land. It’s calculated as the difference between how much you purchased the real property for and how much you sold it for.

Capital gains tax is generally taxed at half the rate of income tax but can be entirely exempt through the principal residence exemption. That means, if your property is considered a principal residence, it may be entirely exempt from capital gains tax!

In this post, we’ll explain exactly what makes a property a principal residence and what the limitations are on this powerful tax exemption.

What is a principal residence?

Though this may seem like a bunch of vague terms, we can further break down some points.

A housing unit refers to a house, cottage, condominium, apartment, trailer, mobile home, or houseboat. Any of these types of properties can qualify as a principal residence and thus be exempt from capital gains tax. The ability to claim properties other than your regular home is helpful in cases where a cottage is growing in value faster than your home, meaning you can use the principal residence exemption on your cottage instead.

Designating a principal residence

You designate a property as your principal residence when you sell it, and you can mark it as your principal residence for any amount of time up to the number of years you’ve owned it. There is also the ability to pick and choose which years you want to designate the properties you own as your principal residence. For example, your main home can be your principal residence between 2007-2012 then your cottage can be your principal residence between 2013-2019. Just remember that you’ll need to pay capital gains tax for every year a property wasn’t designated as a principal residence.

In the past, you could sell your principal residence and not even report it to the Canadian Revenue Agency (CRA). However, changes in 2006 meant to close tax loopholes changed this, and basic information of the sale of a principal property has to be reported on your income tax returns for you to claim the full exemption. If you don’t report the sale, you may be liable for capital gains tax on the sale, late charges, and interest.

Although it would be amazing to have more than one principal residence, each taxpayer can, unfortunately, only have one. For years after 1981, it’s taken a step further and broadened from a taxpayer to the whole family unit. This means that if you designate the family home as a principal residence, your spouse can’t go and designate the cottage as his/her principal residence.

Ordinary residence

So, what if someone designates a property as their principal residence but doesn’t actually live there… What if they own the property as an investment and spend their life living in Florida? Well, that’s where the ordinary residence rule comes in.

For a property to be a principal residence, the owner, the owner’s spouse or common-law partner, or the owner’s children have to occupy the property “ordinarily”. What “ordinarily” means is quite ambiguous once it gets to the courts. With this being said, however, a seasonal residence such as a cottage or houseboat does come within this definition of “ordinarily reside”.

½ Hectare rule

With these rules on principal residence, it might seem like a great idea to buy one big chunk of land and designate it as your principal residence. Unfortunately, the exemption also limits you to how large a principal residence is—i.e., ½ a hectare or 1.24 acre. But, if you can show that you need more land to enjoy your home—for example, your city has a minimum acreage residential zoning requirement or if you need more land to reach city roads—then your principal residence can go beyond the ½ hectare.

Earning income with a principal residence

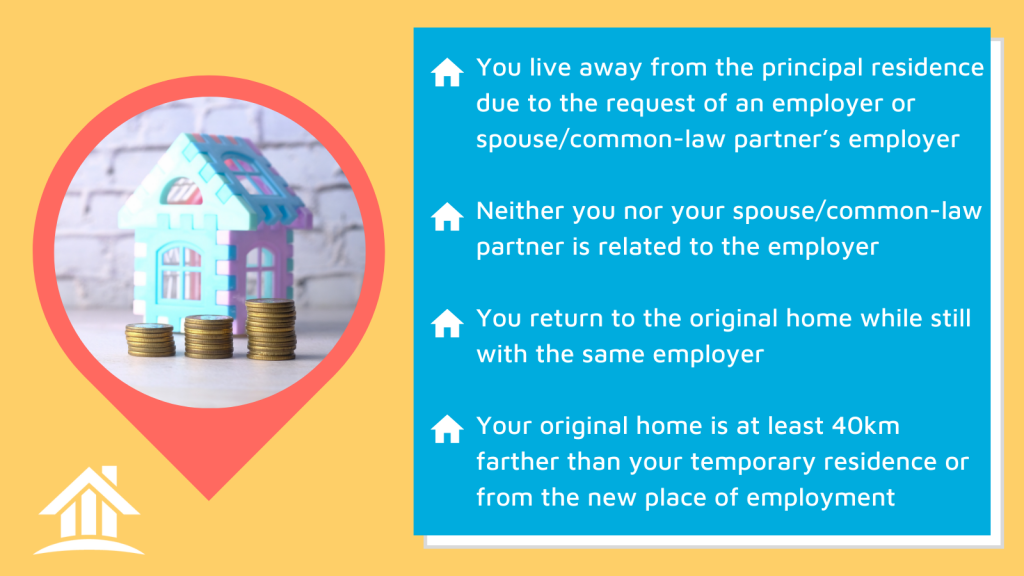

If you change your principal residence to a rental or business property, you can continue to assign it as your principal residence. The only catch is that you must report the net income derived from the property and that you can’t claim any capital cost allowance (i.e., tax deductions for depreciation) on that property. This can continue for four years and be extended if all the following are met:

You can also continue to use your home as your principal residence if you’re renting part of it out while living at the property. If this is a duplex or triplex, where you live in one unit and rent out the rest, then you would claim your unit as your principal residence and the others would be subject to capital gains tax.

If there are no clear divides in which portion of the home is a rental and which part is where you and your family reside, the CRA generally finds that the property can retain its principal residence exemption as long as there were no structural changes to accommodate the rental and there were no capital cost allowances claimed. These rules extend to renting out your property as an Airbnb

The principal property exemption is a powerful tax rule in Canada. It can allow you to be completely exempt from capital gains taxes when selling your home. Due to its power, there are many conditions you need to meet to make a property a principal residence, and there are also various ways to work with the exemption to maximize tax deductions. It’s best to check with your accountant and realtor to see how to really get the best of this exemption.