In January 2018, the Canadian government tightened the qualifications required for a mortgage. They implemented a “stress test” where homebuyers with a 20% down payment had to also theoretically afford certain principal and interest payments in case interest rates go up. This stress test was once again updated in 2021. In 2018, the qualifying mortgage rate needed to pass the stress test was the higher of 2% above the rate negotiated with your lender or the established Bank of Canada five-year rate. Now, it is the higher of 2% above your lender’s rate or 5.25%. These stress tests tend to only apply to “A Lenders,” which are typically the big banks. Those unable to satisfy this stress test can find a more lax mortgage arrangement at B or C Lenders.

Besides the stress test, Credit can disqualify you from a mortgage

In a more case-by-case scenario, a common factor for mortgage rejection is poor or no credit history. A credit score is a number on a scale of 350-900, where 350 is bad and 900 is stellar, which explains a person’s ability to pay off their debts or their debt utilization rate (let’s say you have $10 000 of credit available but have only used $1000. You have a 10% credit utilization ate – the lower the rate, the better the credit score). In addition to your history of paying off debt and credit utilization rate, the score looks at how long you have had a credit account, new inquiries for credit, and other factors.

Quite frequently, first-time homebuyers run into issues with their credit score. This could have been a mismanaged credit card or high student loan debts, which would have resulted in a terrible credit score. Another issue is if the person has never had credit. This would result in no credit history that the lender could rely on.

There is hope, however. Even with a bad or missing credit history, individuals can still get approved if they have a guarantor or co-signer. This is someone legally liable for your loan payments if you default. For many first-time homebuyers, a co-signor or guarantor is a family member.

Self-employment is another common way people find themselves unable to approve their mortgage applications. Due to the instability of their income, A lenders find self-employed people a greater risk. Thus, the bank may require a higher taxable income or a larger down payment to approve someone self-employed.

Lastly, life is full of twists and turns, and many people make financial mistakes; this can result in bankruptcy. People who have declared bankruptcy in the past few years won’t get approved by any major bank and will have to seek help from a B or private lender.

The alternatives

While A lenders consist of the major banks (RBC, TD, CIBC and Scotiabank) and the major credit unions (Meridian, Vancity and more), there are many more organizations willing to lend money. However, just because an A lender has declined you doesn’t mean your only option is to take a stroll to a dark alleyway and find a loan shark that charges a 50% interest rate. That’s where B and C Lenders come in: alternative lenders have a lower barrier to entry in exchange for a higher interest rate. They also commonly charge a processing fee of 1-2% of the mortgage and a brokerage fee, usually 0.5% of the mortgage.

It should be noted that using a B or C lender often is not a permanent fix. The mortgage terms tend to be shorter, up to 5 years. Many borrowers use an alternative lender to rebuild their credit and then switch to a mortgage with an A lender later on.

B Lenders

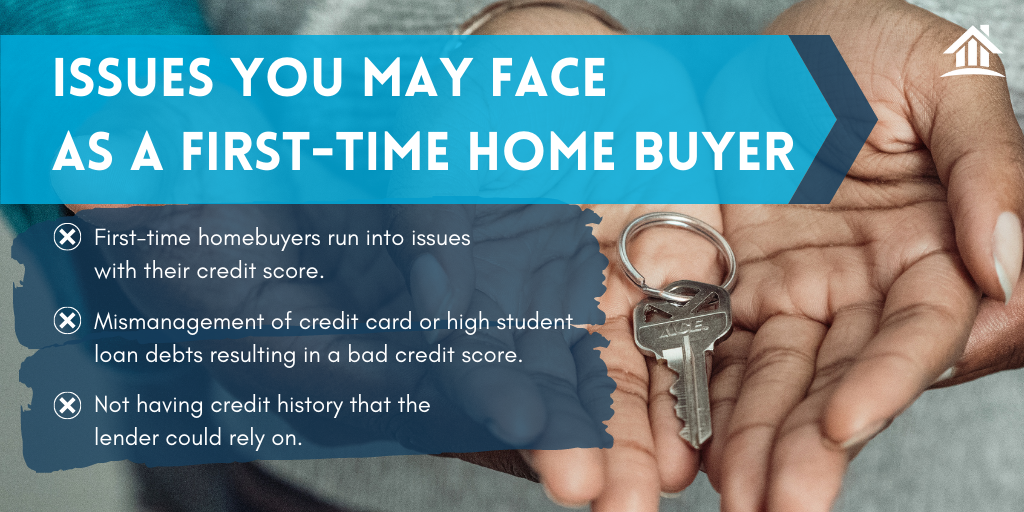

Contrary to what one might think, there are dozens of banks in Canada. Many of these smaller banks, such as Equitable Banks or B2B Bank, allow clients to miss one or more of the components that the big banks look for in a client. For example, they may approve someone even though they have a poor credit history if the applicant has a stable job and no recent bankruptcies. B lenders also more heavily consider the property being purchased in offsetting default risk.

B lenders can also be found at the Big Banks. With Canada’s housing industry roaring over the past couple of years, the major banks have diversified, and their mortgage departments often feature B level lending arrangements.

There is no need to fear B lenders. B lenders are still reliable organizations, commonly listed on the stock exchange, and have many clients worldwide. While banks dominate the mortgage market at approximately 71% of the market and credit unions at 15% of the market, the other 15% or so of the market are B or C lenders. The Canadian Mortgage and Housing Company also approve them as a mortgage lender.

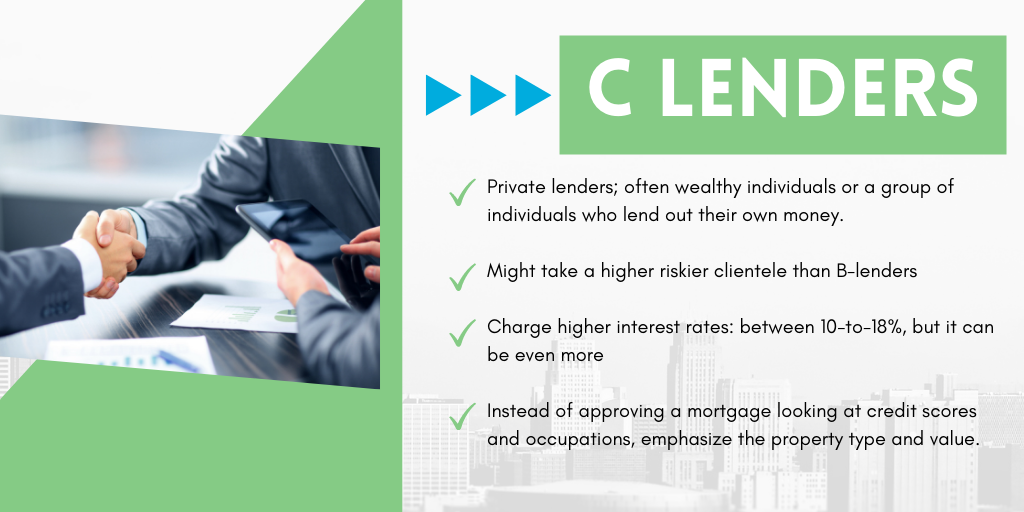

C Lenders (Private lenders)

After both A and B lenders have turned you down, private lenders are usually the last resort. These lenders are often wealthy individuals or a group of individuals who lend out their own money for a better return, such as Mortgage Investment Entities (which can also be B lenders). However, as private lenders take on an even riskier clientele than their B-lending counterparts, they also charge a higher interest rate. As a result, you can expect interest rates anywhere between 10-to-18% and even more.

The barriers to entry for these mortgages are lower than that of B lenders. Instead of approving a mortgage only on credit scores and occupations, a private lender weighs more emphasis on the property type and value. If you are refinancing a home, they also consider the amount of equity you already have. This is not to say that other lenders don’t consider the property itself, but private lenders care more about it. It is the type of property that lenders seek to buy, and their high-interest rates that reduce the risk that C Lenders hold.

Lastly, because you may not be dealing with a massive and trustworthy corporation in the private lending landscape, it is best to have a lawyer thoroughly look over any documentation.

How to get a subprime mortgage: B and C Lenders

The term “subprime mortgage” should not give you a flashback to the 2008 recession. Subprime mortgages are realistically a part of everyday life and refer to any loan granted to those with a poor credit score. The mortgages provided by B and C lenders are usually subprime mortgages.

So if you’ve decided to get one, where should you start? Unlike A lenders, B and C lenders do not have a brick-and-mortar stores at the corners of every major intersection. And while you could scour the websites of every B-lender bank looking for the best rate, it may be more efficient to contact a mortgage specialist.

Mortgage brokerages or freelance mortgage specialists help homebuyers navigate the alternative lending market. They have access to multiple lenders and their mortgage rates, and they can even negotiate a lower rate for you. With their expertise, they can also find the most suitable lender for your situation. However, they take a percentage of your total mortgage as a commission, which can motivate them to approve you for a mortgage you shouldn’t be approved for.

Online mortgage brokers are now also a popular method to scour the B-and-C lender landscapes. These brokers cut margins by operating online and passing the savings onto their customers. Using technology, they can find out who the best lender is for you.

If a major bank has denied your dream mortgage, there’s still hope. Though it may cost a bit more in terms of interest, you can use B and C lenders as a temporary stepping stone you get your credit back on its feet. B and C lenders can help you get one step further to do what you thought was previously impossible.